How Much Energy Does Bitcoin Consume?

Here’s how energy-intensive Bitcoin’s Proof of Work consensus mechanism is and what’s being done to offset it.

Key Takeaways

- Bitcoin’s energy consumption is a pressing issue, with annual estimates ranging from 91 to 150 terawatt-hours, primarily due to its complex Proof of Work mining process.

- Comparatively, Bitcoin’s electricity consumption per transaction is significantly higher than that of Visa and Proof of Stake networks.

- Despite the environmental concerns, Bitcoin’s fundamental Proof of Work mechanism is unlikely to change, as it contributes to its scarcity and network resilience.

- Efforts to reduce Bitcoin’s carbon footprint include a growing use of renewable energy sources, accounting for over 50% of mining, and carbon offsetting methods like carbon credits and sequestration.

- As the cryptocurrency industry becomes more environmentally conscious, green crypto projects and initiatives are emerging to address the environmental impact of blockchain technologies.

How Much Energy Does Bitcoin Consume?

Bitcoin requires a significant amount of energy, estimated to consume about 91 terawatt-hours (TWh) of electricity annually, which is more than Finland uses. Another estimate suggests that Bitcoin currently consumes around 150 TWh of electricity annually.

According to the Cambridge Centre for Alternative Finance, Bitcoin consumes around 87 TWh per year (at the time of writing). The energy consumption of Bitcoin mining is a result of the complex process involved in creating cryptocurrencies, which requires specialised machines and a significant amount of computational power.

Electricity Consumption per Transaction

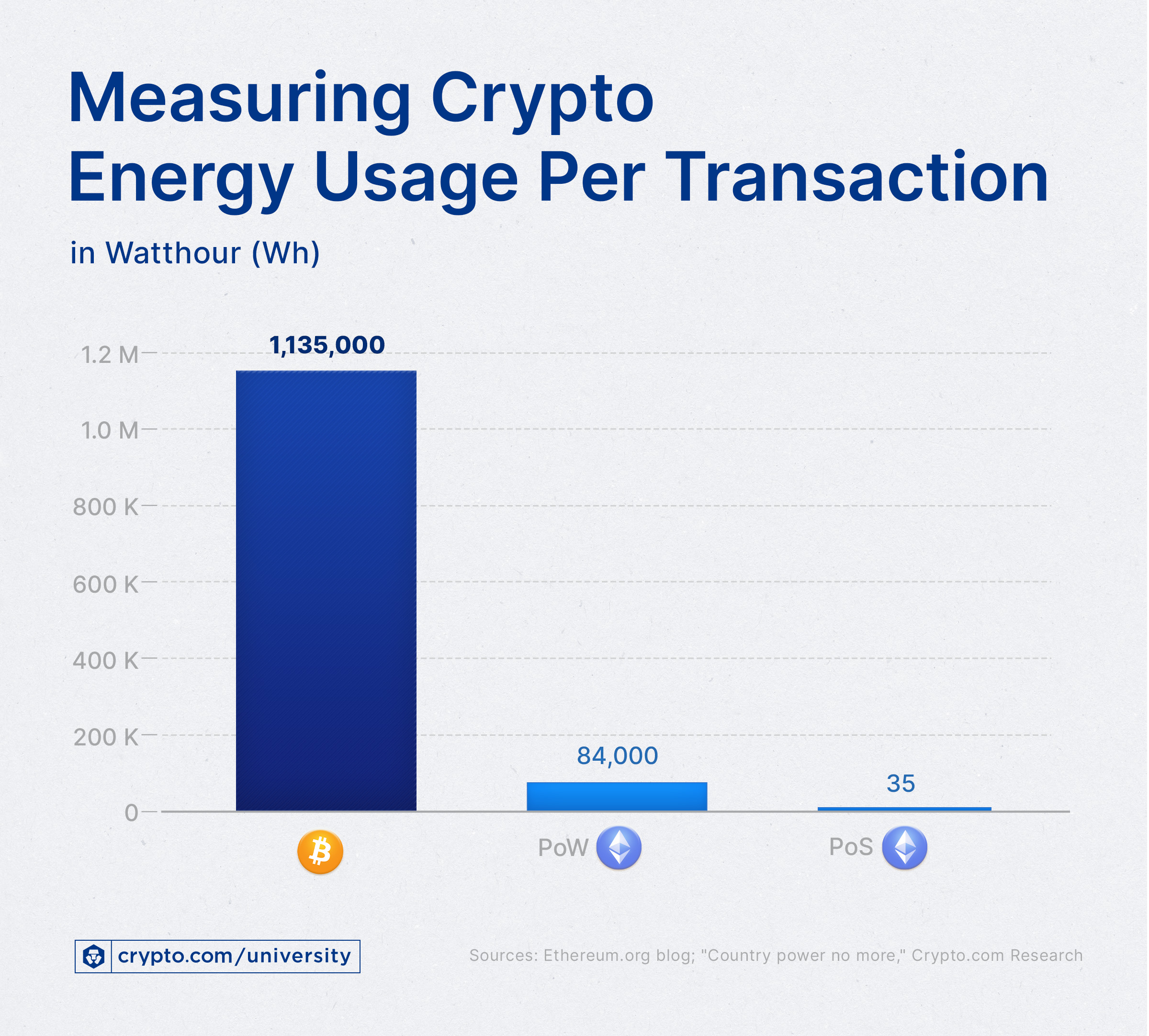

The chart below presents the comparison of the electricity consumption per transaction between Bitcoin, Ethereum, multiple Proof of Stake (PoS) networks, and Visa. It should be noted that this may not be a perfect comparison (e.g., Bitcoin’s energy consumption is not determined by transaction volume, unlike Visa); however, we include it here nonetheless for completeness.

From the chart, electricity consumption per transaction of a PoS network is nearer to that of Visa, whereas Bitcoin and Ethereum Classic have much higher electricity consumption.

Why Is Bitcoin So Energy-Intensive?

Bitcoin’s energy-intensive Proof of Work (PoW) process involves solving complex mathematical problems to validate transactions and add them to the blockchain. This requires a significant amount of computational power, which in turn requires a substantial amount of electricity. Additionally, the decentralised nature of Bitcoin mining means that multiple miners compete to solve these problems, leading to higher energy consumption. As more miners join the network and the difficulty of the problems increases, the energy consumption of Bitcoin also increases.

Learn more about the Proof of Work consensus mechanism and Bitcoin mining.

Bitcoin was the first successful cryptocurrency, and PoW was one of the first types of consensus mechanisms, but many less energy-intensive consensus mechanisms have been developed since then. Ethereum, the second-largest cryptocurrency by market capitalisation, made the switch from PoW to the more environmentally friendly PoS in 2022 (the old PoW mining network lives on as Ethereum Classic).

Many other early cryptocurrencies like Solana were also conceived on the premise of creating a cryptocurrency that consumes less energy than Bitcoin. Does that mean Bitcoin will eventually also change its consensus mechanism to a less energy-intensive one? Unlikely, as PoW is hard-coded into Bitcoin’s blockchain, and mining is a fundamental part of much of what makes Bitcoin unique.

Mining ensures that Bitcoin remains a scarce commodity, making it more valuable than an inflationary one. And its complex consensus mechanism also makes the network more resilient against attacks.

Can Bitcoin’s Energy Consumption Be Reduced?

While Bitcoin’s energy consumption cannot be reduced as long as it runs on PoW, the energy can be 1) sourced from sustainable sources, and 2) offset.

Ways to Reduce Bitcoin’s Carbon Footprint

Almost 50% of Bitcoin mining already uses renewable energy, according to research by ESG analyst and investor Daniel Batten.

Bitcoin and Renewable Energy

According to the ESG study, 23.12% of all Bitcoin miners use hydropower to run their setups.

Wind energy generates 13.98% of the power needed for Bitcoin mining, while nuclear/nonrenewable and solar account for 7.94% and 4.98%, respectively. A side note that the grouping of nuclear into clean energies is debated. Other renewable energy sources account for about 2.40% of Bitcoin mining.

This adds up to 52.4% of all Bitcoin mining relying on renewable energy for its power needs, and the trend is expected to continue growing in the coming years as traditional energy sources become more expensive and less attractive.

Offsetting Bitcoin’s Energy Consumption

The other option to make Bitcoin greener is carbon offsetting.

Fossil fuels — burning oil or coal to create energy — come with massive carbon emissions. In other words, burning them blows large amounts of CO2 into the atmosphere, which impacts air quality and our climate. They are the main culprit behind the climate change discussion and why the world as a whole is trying to reduce their energy consumption.

In other words, what’s bad about generating and consuming electricity is the carbon it emits and its effects on our planet. The most common methods of going greener include carbon credits and offsets like carbon sequestration (i.e., capturing the carbon through planting trees). Here’s the difference between carbon credits and offsets:

Carbon credit

An allowance given to one company or country for a certain amount of CO2 emissions. Typically, one carbon credit is equivalent to the permission to emit one ton (or metric ton, mt) of CO2.

Carbon offset

A measurable and verifiable reduction in the emission of carbon, or an increase in carbon storage (e.g., land restoration, tree planting), which are mainly used to compensate for emissions occurring elsewhere.

The crypto industry is aware of its poor environmental image, and green crypto projects, including tokenised carbon credits, have been emerging as a result. While there isn’t enough data on how much carbon from Bitcoin mining is offset, more about the options and their positive impact on the environment are found in this report.

Conclusion

Bitcoin’s energy consumption remains a concern, with estimates suggesting it consumes around 87 TWh annually. The energy-intensive nature of Bitcoin mining is due to its complex Proof of Work (PoW) process, requiring substantial computational power. While some cryptocurrencies have transitioned to greener consensus mechanisms, it’s unlikely that Bitcoin will change its fundamental PoW system.

To mitigate its carbon footprint, Bitcoin relies on renewable energy sources, with over 50% of mining already using renewables, and carbon offsetting methods, such as carbon credits and carbon sequestration. These efforts aim to address Bitcoin’s environmental impact and contribute to a more sustainable future.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Ready to start your crypto journey?

Frequently Asked Questions

As the hashrate increases, so do the power requirements to mine a coin. Estimates showed that, in 2023, dedicated mining companies with highly efficient setups would consume about 155,000 kilowatt hours (kWh) of electricity to mine one Bitcoin. The average energy consumed for one Bitcoin transaction is 851.77 kWh, equivalent to about a month of electricity for the average US household.

The cost of mining Bitcoin depends on the breadth of miners on the network, the corresponding difficulty requirements to maintain the release of one new Bitcoin into supply every 10 minutes, and local energy prices. As of the 2024 halving event, estimates put the average cost of mining Bitcoin close to $38,000.

Large-scale Bitcoin mining operations often turn to renewables like solar panels and wind farms to generate on-site electricity, reducing their reliance on the energy grid. The ‘green’ energy derived from these sources represents only a tiny fraction of the mine’s energy needs.

Miners also choose the latest and most energy-efficient equipment for their needs. The latest Application-Specific Integrated Circuits (ASICs) mining rigs are more energy-efficient than their predecessors, and efficient cooling systems maintain Bitcoin mining hardware for a fraction of the energy older models require. Some miners leverage their setup for additional savings in other areas, such as heat recycling to preserve the heat generated by their rigs to heat homes, offsetting a portion of their mining costs.

The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services. You may obtain access to such products and services on the Crypto.com App.

Please note that the availability of the products and services on the Crypto.com App is subject to jurisdictional limitations. Crypto.com may not offer certain products, features and/or services on the Crypto.com App in certain jurisdictions due to potential or actual regulatory restrictions.

Copyright © 2018 - 2024 Crypto.com. All rights reserved.