Quick Take

- US spot Bitcoin ETFs recorded the highest net inflow in a single month on 5 July; Fidelity and Sygnum partner with Chainlink to bring NAV data on-chain; Mt Gox began repayment in BTC and BCH on 5 July

- US spot Bitcoin ETFs had a weekly net inflow of US$311 million last week (past five trading days), compared to a net outflow of $37 million the week before. Grayscale Bitcoin Trust ETF’s (GBTC) weekly net outflow settled at $115 million.

- On the macro side, Fed Chair Powell said the US is back on a ‘disinflationary path’ but would need more data before lowering interest rates. Nonfarm payrolls increased by 206,000 jobs in June, a slowdown in job growth compared to May but still higher than expected. Unemployment rate increased to 4.1%, a 2.5-year high, suggesting a cooling labour market. ECB President Largarde said the ECB needs more time to conclude that the inflation trajectory is back to the 2% target before lowering interest rates further. The latest CME FedWatch Tool shows a 72% probability of a September rate cut.

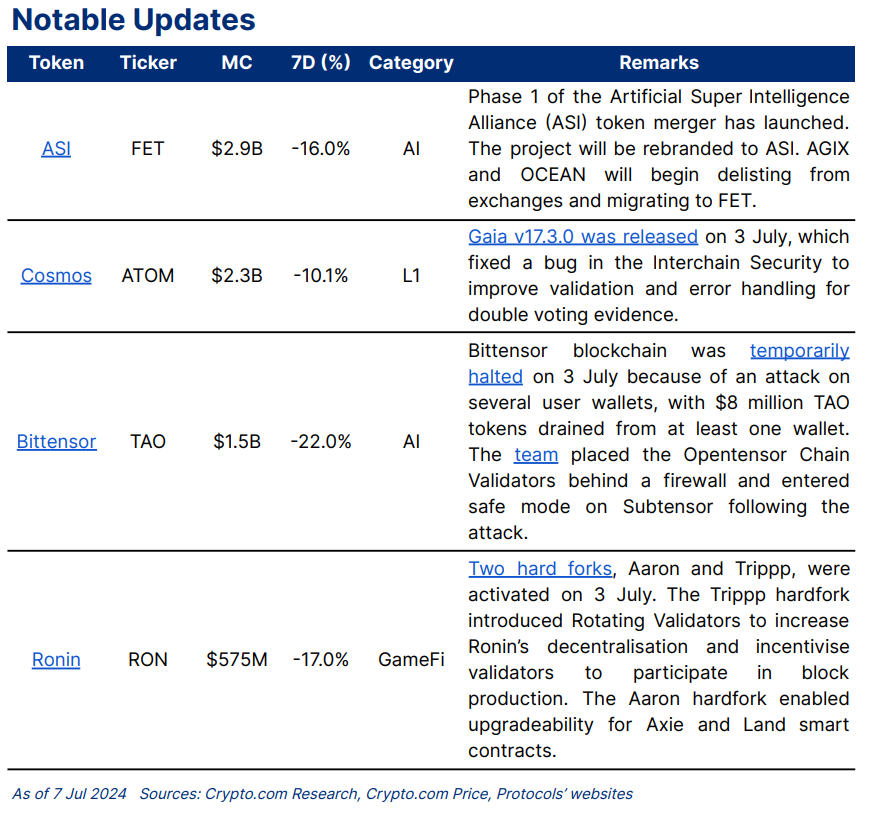

- Notable updates: Cosmos (ATOM) released Gaia v17.3.0; Artificial Superintelligence Alliance (FET) launched phase 1 of its token merger; Ronin (RON) activated two hard forks, Aaron and Trippp

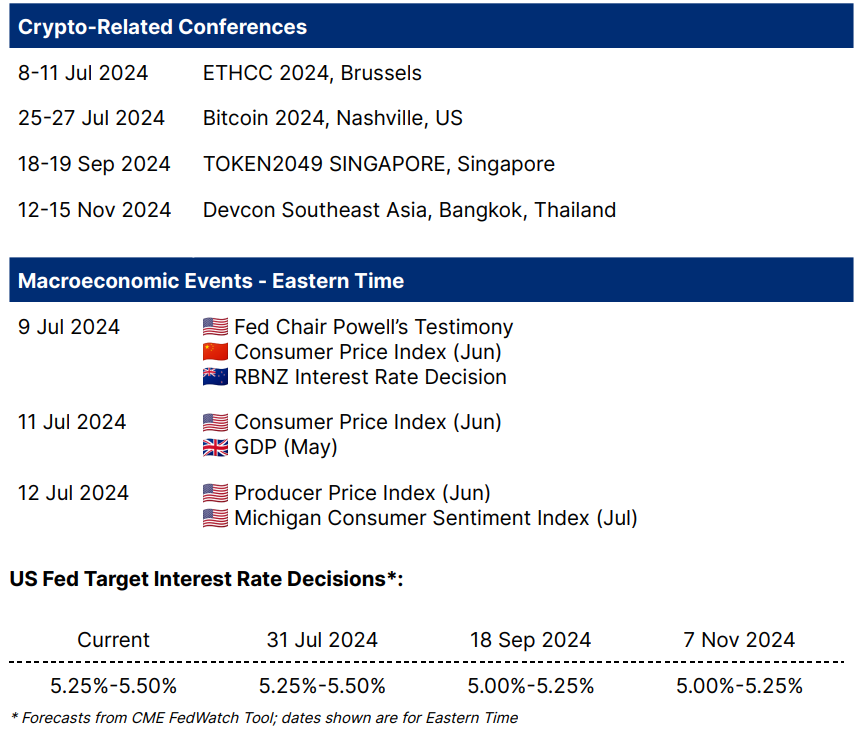

- Notable events in the coming week: Fed Chair Powell Testimony, US Consumer Price Index and Producer Price Index

Weekly Market Index

Price index decreased by -8.87% last week, while the volume and volatility indices increased by +26.67% and +0.42%, respectively. Price drop coincided with Mt. Gox commencing repayments in Bitcoin and Bitcoin Cash, as well as reports of US and German governments sending Bitcoin to exchanges.

Chart of the Week

Bitcoin’s price declined below the 200-day simple moving average line for four consecutive days since 4 July. This was amid volatile Bitcoin price action recently, with BTC falling to $54,000 level on 5 July, the lowest since February.

This coincided with Mt. Gox commencing repayments to customers in Bitcoin and Bitcoin Cash on 5 July, sending over 47,288 BTC ($2.7 billion) from cold storage to an unidentified wallet. US and German governments have also sent $738 million worth of Bitcoin to exchanges over the last two weeks.

At the same time, US spot Bitcoin ETFs recorded the highest net inflow in a single month (from 7 June to 5 July) of $143 million on 5 July, according to data from Farside Investors. This is largely contributed by a $117 million net inflow to Fidelity’s FBTC. Blackrock’s IBIT recorded zero net flow, while Grayscale’s GBTC recorded a net outflow of $29 million. The record net inflow potentially suggests that institutional investors are using the recent dip to accumulate Bitcoin.

Weekly Performance

BTC and ETH decreased by -7.6% and -12.2%, respectively, in the past seven days. The price action for other selected top market cap tokens was all down, where LDO (-19.5%) led the drop.

Key categories were all down in terms of market capitalisation changes in the past seven days, with the L-2 category leading the drop.

News Highlights

Regulations

- The Bank for International Settlements (BIS) Basel Committee made policy decisions on the disclosure of banks’ crypto exposure and plans to publish updated standards in July. This is intended to enhance transparency and is part of the Basel III reform that started in 2019.

- European Banking Authority (EBA) announced the extension of Travel Rule guidelines to crypto service providers starting 30 December. The regulations, Regulation (EU) 2023/1113 (Travel Rule guidelines), require the reporting of information on the transfer of funds and crypto assets and is aimed at enhancing anti-money laundering measures.

- Circle announced that its stablecoins, USDC and EURC, are compliant with EU’s Markets in Crypto Assets (MiCA) regulation. This enables Circle to issue these stablecoins natively to EU customers, effective 1 July.

- Paxos received approval from Singapore’s central bank to offer ‘digital payment token services’. This allows the company to issue stablecoins that are compliant with Singapore’s stablecoin framework. In addition, Paxos partnered with DBS Bank for cash management needs and custody of stablecoin reserves.

- South Korea’s new virtual asset user protection law, Act on the Protection of Virtual Asset Users (PVAU), will come into full force on 19 July. It requires crypto exchanges to follow stricter guidelines for token listings and review cryptocurrencies listed on their platforms every six months. In addition, the nation’s Financial Supervisory Service announced it has developed a 24-hour surveillance system with local exchanges for suspicious cryptocurrency activity, which is expected to go live on 19 July.

Others

- Fidelity and digital asset bank, Sygnum, partnered with Chainlink to bring net asset value (NAV) data on-chain. The partnership aims to provide transparency and accessibility for NAV data in tokenised assets.

- Mt. Gox began repayment in Bitcoin and Bitcoin Cash on 5 July. This coincides with reports of 47,288 BTC being moved from addresses associated with Mt. Gox Trustee.

- Cambodia was chosen as the site for a blockchain-based pilot programme for Universal Trusted Credentials (UTC) under the United Nations Development Programme (UNDP). Internet Computer (ICP) will provide infrastructure for securing and managing UTC. The pilot is expected to roll out in ten countries over time.

Recent Research Reports

|  |  |

|---|---|---|

| Alpha Navigator: Quest for Alpha [June 2024] | New Developments in GameFi: Play-to-Airdrop and Prediction Markets | Spot Ethereum ETFs |

| Alpha Navigator: Quest for Alpha [June 2024] |

|---|---|

| New Developments in GameFi: Play-to-Airdrop and Prediction Markets |

| Spot Ethereum ETFs |

- Alpha Navigator: Quest for Alpha [June 2024]: Equities and Fixed Income were up in June, while Cryptocurrencies dropped. Fed remains cautious on rate cuts, while ECB cuts rates for the first time in five years.

- New Developments in GameFi: Play-to-Airdrop and Prediction Markets: Both play-to-airdrop and prediction markets have blurred the boundaries between Web2 and Web3. Our latest report looks into new developments in GameFi by delving deeper into these two trends.

- Spot Ethereum ETFs: In May, the SEC approved eight spot Ether ETFs, potentially launching in July. These ETFs, unlike Bitcoin’s, offer staking rewards. Projections estimate ETH ETFs could see $1.4 to $4.5 billion in inflows and $700 million to $2.4 billion in trading volume within six months. Ethereum’s scalability upgrades enhance its investment appeal.

Recent University Articles

|  |  |

|---|---|---|

| What Is ORDI and How to Buy the ORDI Token | What Are Crypto Airdrop Scams and How to Avoid Them | What Is Stacks (STX) and How Does Stacking Work? |

| What Is ORDI and How to Buy the ORDI Token |

|---|---|

| What Are Crypto Airdrop Scams and How to Avoid Them |

| What Is Stacks (STX) and How Does Stacking Work? |

- What Is ORDI and How to Buy the ORDI Token: ORDI was the first BRC-20 token on the Bitcoin blockchain. Here’s an introduction to the Ordinals meme coin and how it works.

- What Are Crypto Airdrop Scams and How to Avoid Them: Crypto airdrop scams are making the rounds. Here’s how to spot phishing airdrops and protect your assets from scammers.

- What Is Stacks (STX) and How Does Stacking Work?: As a Bitcoin Layer-2, Stacks allows developers to build Bitcoin dapps and create new use cases for the ecosystem. Here’s how it works.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are register