Quick Take

- BlackRock’s tokenised fund BUIDL surpassed US$500 million in market capitalisation; US spot Ether ETF issuers filed amended S-1 with the SEC; the Germany government reportedly completed BTC sales

- US spot Bitcoin ETFs had a weekly net inflow of $1,048 million last week (past five trading days), compared to a net outflow of $311 million the week before. Grayscale Bitcoin Trust ETF’s (GBTC) weekly net outflow settled at $35 million.

- On the macro side, US consumer prices fell for the first time in four years in June, with the CPI index dropping 0.1% month-on-month (increasing 3% year-on-year). Fed Chair Powell said in remarks to Congress that inflation is not the only risk the US faces, as the timing of interest rate cuts would also impact economic activity and employment. He mentioned the US is “no longer an overheated economy” with a labour market that has “cooled considerably”. Yet, Powell did not make explicit remarks about the timing of rate cuts. The latest CME FedWatch Tool shows a 96% probability of a September rate cut.

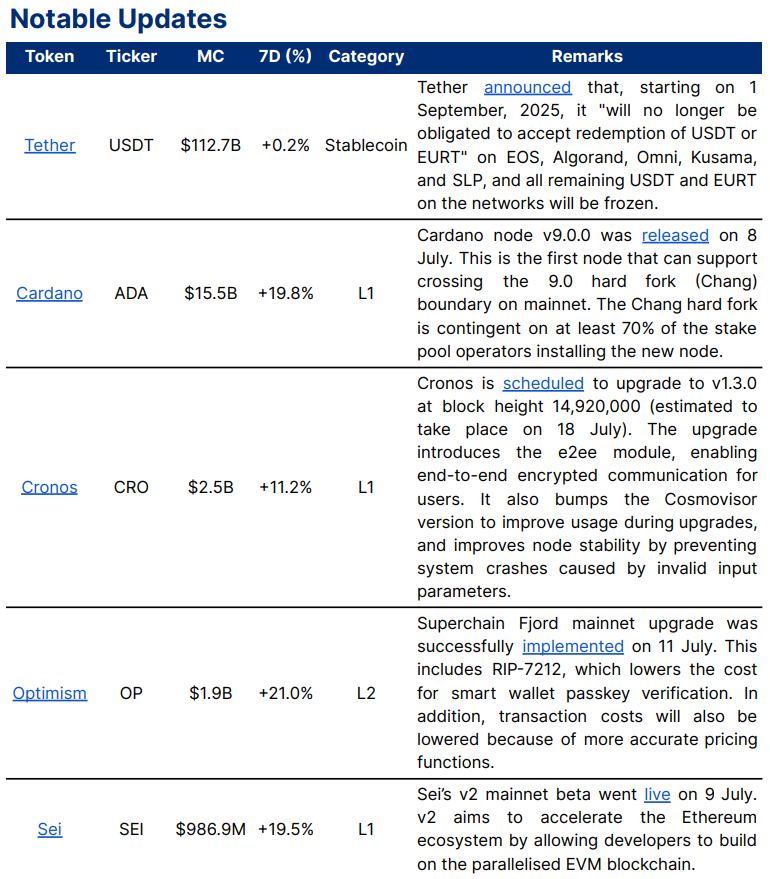

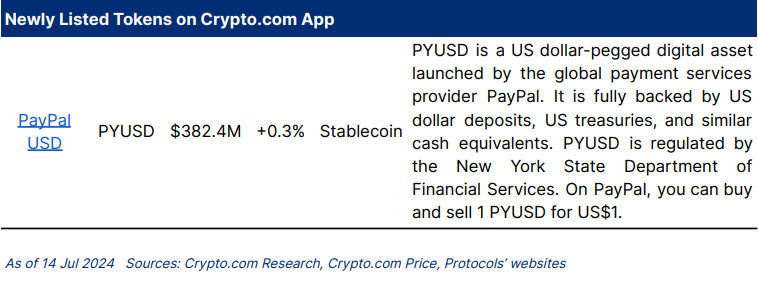

- Notable updates: Cronos (CRO) is scheduled to upgrade to v1.3.0; Cardano (ADA) released node v9.0.0; Tether (USDT) announced the discontinuation of USDT and EURT on EOS, Algorand, Omni, Kusama, and SLP; Sei v2 mainnet beta is live; Optimism (OP) Superchain Fjord mainnet upgrade was successfully implemented; the Crypto.com App listed PayPal USD (PYUSD)

- Notable events in the coming week: ECB interest rate decision

Weekly Market Index

The price index increased by +6.51% last week, while the volume and volatility indices decreased by -11.92% and -40.80%, respectively.

Chart of the Week

The BlackRock USD Institutional Digital Liquidity Fund, BUIDL, reached a market capitalisation of $500 million on 8 July, less than four months after its launch. It is the first tokenised treasury fund to reach this milestone, supported by real-world asset tokenisation firm, Ondo Finance, purchasing BUIDL to back its OUSG token.

As of 14 July, the total market capitalisation of tokenised government securities reached $1.7 billion. BUIDL is the largest player with $524 million in market capitalisation, followed by Franklin Templeton’s BENJI with $402 million.

Weekly Performance

BTC and ETH increased by +5.6% and +7.5%, respectively, in the past seven days. The price action for other selected top market capitalisation tokens was all up, with ICP (+23.5%) leading.

Key categories were all up in market capitalisation changes in the past seven days, except for the meme category. The L2 category led the rise.

News Highlights

ETFs

- US spot Ether ETF issuers, including VanEck, Grayscale, Fidelity, BlackRock, 21Shares, Franklin Templeton, and Bitwise, filed amended S-1 registration statements with the SEC by the 8 July deadline.

- Cboe Exchange has officially filed 19b-4 with the SEC, asking to list VanEck and 21Share’s Solana-based ETFs if and when approved. The SEC has 240 days to make a decision once it acknowledges receipt of the filing.

- DigitalX’s Bitcoin ETF, BTXX, commenced trading on the Australian Securities Exchange (ASX) on 12 July. It is the second Bitcoin ETF in Australia, issued in partnership with K2 Asset Management and Canadian digital assets company 3iQ.

- 21Shares announced the launch of 21Shares Immutable ETP (AIMX), 21Shares Injective Staking ETP (AINJ), and 21Shares Sui Staking ETP (ASUI) on Euronext Paris and Euronext Amsterdam. The three ETPs are the latest additions to the company’s European product lineup, providing investors exposure to underlying crypto assets.

Others

- Germany’s government has reportedly completed all its BTC sales as of 12 July, according to data from Arkham Intelligence. This amounted to a total of around 50,000 BTC ($3 billion at the time of writing). Since three weeks ago, Germany has started transferring Bitcoin to various cryptocurrency trading platforms.

- Goldman Sachs is reportedly planning to launch three tokenisation projects by the end of 2024, according to Fortune. One will target the US fund sector and another will focus on the European debt markets.

- Standard Chartered’s subsidiary, Zodia Markets, is in acquisition talks with over-the-counter digital asset trading and settlement services business Elwood Capital Management, according to Bloomberg. This follows an announced partnership between Zodia Custody (sister firm of Zodia Markets) and decentralised lending platform Maple Finance.

- DWS, an asset manager majority-owned by Deutsche Bank, confirmed plans to launch the first regulated Euro-backed stablecoin in 2025. The issuance will be under a joint venture firm called AllUnity, and the stablecoin will be fully regulated by Germany’s financial regulator, BaFin.

Recent Research Reports

|  |  |

|---|---|---|

| Alpha Navigator: Quest for Alpha [June 2024] | New Developments in GameFi: Play-to-Airdrop and Prediction Markets | Research Roundup Newsletter [June 2024] |

| Alpha Navigator: Quest for Alpha [June 2024] |

|---|---|

| New Developments in GameFi: Play-to-Airdrop and Prediction Markets |

| Research Roundup Newsletter [June 2024] |

- Alpha Navigator: Quest for Alpha [June 2024]: Equities and Fixed Income were up in June, while Cryptocurrencies dropped. Fed remains cautious on rate cuts, while ECB cuts rates for the first time in five years.

- New Developments in GameFi: Play-to-Airdrop and Prediction Markets: Both play-to-airdrop and prediction markets have blurred the boundaries between Web2 and Web3. Our latest report looks into new developments in GameFi by delving deeper into these two trends.

- Research Roundup Newsletter [June 2024]: We present our latest issue of Research Roundup, featuring our deep dives into ETH ETFs, GameFi, and New Layer-2s.

Recent University Articles

|  |  |

|---|---|---|

| What Is ORDI and How to Buy the ORDI Token | What Are Crypto Airdrop Scams and How to Avoid Them | Trading Cryptocurrency with Moving Averages |

| What Is ORDI and How to Buy the ORDI Token |

|---|---|

| What Are Crypto Airdrop Scams and How to Avoid Them |

| Trading Cryptocurrency with Moving Averages |

- What Is ORDI and How to Buy the ORDI Token: ORDI was the first BRC-20 token on the Bitcoin blockchain. Here’s an introduction to the Ordinals meme coin and how it works.

- What Are Crypto Airdrop Scams and How to Avoid Them: Crypto airdrop scams are making the rounds. Here’s how to spot phishing airdrops and protect your assets from scammers.

- Trading Cryptocurrency With Moving Averages: Moving averages smooth out price data to help identify trends and reversal points. Here’s how to use them in crypto trading.

Catalyst Calendar

We’re all ears.

Your feedback helps make our reporting more insightful. Tell us how we can improve this newsletter by taking the survey below. It will take less than a minute of your time. Thank you!

Author

Research and Insights Team

Disclaimer:

The information in this report is provided as general market commentary by Crypto.com and its affiliates, and does not constitute any financial, investment, legal, tax, or any other advice. This report is not intended to offer or recommend any access to products and/or services. While we endeavour to publish and maintain accurate information, we do not guarantee the accuracy, completeness, or usefulness of any information in this report nor do we adopt nor endorse, nor are we responsible for, the accuracy or reliability of any information submitted by other parties.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of, or located in a jurisdiction, where such distribution or use would be contrary to applicable law or that would subject Crypto.com and/or its affiliates to any registration or licensing requirement.

The brands and the logos appearing in this report are register