Key Takeaways:

- Tokenomics describes the economic system around a cryptocurrency, encompassing its issuance, supply distribution, utility, incentives, token burns, etc.

- Factors influencing token value include supply and demand, market speculation, and the perceived utility of the token within its ecosystem.

- Token utility refers to the various functions a token can perform, such as transaction fees, governance, and access privileges, while incentives include rewards, airdrops, and loyalty programmes to encourage participation and holding.

What Is Tokenomics?

A portmanteau of the words ‘token’ and ‘economics’, tokenomics refers to the study and design of the economic systems surrounding a cryptocurrency. It involves understanding how tokens are distributed and utilised, and how they can potentially increase in value.

Tokenomics is a vital aspect of cryptocurrency DYOR because it helps determine the project’s long-term viability and attractiveness to users and traders. By analysing tokenomics, stakeholders can make informed decisions about the potential success and sustainability of a cryptocurrency.

What Are the Key Factors in Tokenomics?

Several key factors play a role in shaping the tokenomics of a cryptocurrency. They include:

1. Supply

2. Distribution

3. Utility

4. Incentives

5. Burns

Each of these elements contributes to the overall economic ecosystem of a cryptocurrency and influences its performance and adoption.

1. Supply

Supply and demand are the primary factors impacting the price of any good or service. The same goes for cryptocurrency. This includes defining the maximum total supply and the current circulating supply of the token.

The circulating supply refers to the number of tokens currently in circulation and available to the public. This is an important metric, as the market capitalisation of a cryptocurrency is calculated by multiplying the current unit price by the circulating supply.

Cryptocurrencies can be designed with either a limited or an infinite total supply. For example, Bitcoin (BTC) has a hard-capped maximum supply of 21 million coins, while Ethereum (ETH) has an uncapped supply (i.e., potentially infinite total supply).

2. Distribution

Token distribution refers to how tokens are allocated and when they are to be dispersed to traders and stakeholders. This factor can significantly influence the stability and decentralisation of a cryptocurrency.

Cryptocurrencies can generally be launched and distributed to the public in one of two ways: a fair launch or a pre-mining launch. In a fair launch model, there is no early access or private allocation of the tokens before they are minted and made available to the general public. Bitcoin (BTC) utilised this fair launch approach.

Conversely, the pre-mining launch allows a portion of the total token supply to be minted and distributed to a select group of individuals or entities before the token is offered to the wider public. Ethereum (ETH) is an example that followed a pre-mining launch strategy.

The choice between a fair launch or pre-mining distribution has implications for the initial token distribution, decentralisation, and broader adoption of the cryptocurrency project.

Initial Distribution and Airdrops

The initial distribution of tokens can occur through methods like initial coin offerings (ICOs), initial exchange offerings (IEOs), or airdrops.

The method chosen for distribution can affect the perception of the token and its initial value. A well-planned distribution ensures that tokens are widely dispersed and not concentrated in the hands of a few entities, which can lead to centralisation and manipulation.

Vesting Periods

Vesting periods are used to lock up tokens for a certain period, preventing early investors and team members from selling their tokens immediately. This helps in maintaining stability and preventing a sudden influx of tokens into the market, which could negatively impact the price.

3. Utility

Token utility refers to the various functions a token can perform within its ecosystem. The more use cases a token has, the higher its utility, which can impact token value.

Transaction Fees

Blockchain networks usually use their native tokens to pay for transaction fees on their networks. For instance, Ethereum requires Ether (ETH) to pay for gas fees, which are necessary to execute transactions and smart contracts. This creates a continuous demand for the token, supporting its value.

Governance

Governance tokens allow holders to participate in the decision-making processes of a cryptocurrency project. Token holders can vote on proposals, changes to the protocol, and other important decisions. This democratic approach can increase user engagement and commitment to the project.

Access and Privileges

Tokens can also grant holders access to specific features, services, or privileges within a network. For example, holding a certain number of tokens might provide users with access to premium services, higher transaction limits, or exclusive content. This incentivises holding and using the tokens, increasing their demand and utility.

4. Incentives

Token incentives are mechanisms designed to encourage specific behaviours within the ecosystem. These include staking, yield farming, and other rewards.

Staking

Some cryptocurrencies use staking mechanisms to distribute tokens. In staking, token holders lock up their tokens to support network operations, such as validating transactions. In return, they receive rewards in the form of additional tokens. This encourages holding and long-term commitment to the cryptocurrency.

Rewards

Besides staking, rewards can be given for activities like trading, providing liquidity, or participating in governance.

Yield Farming

Yield farming involves lending cryptocurrency assets to earn rewards or interest. This incentivises users to lock up their tokens, reducing the circulating supply and potentially increasing the token’s value.

Loyalty Programmes

Loyalty programmes reward long-term holders and active participants in the ecosystem. These programmes can include tiered rewards based on the length of time tokens are held or the level of activity within the network. Loyalty programmes foster a strong community and encourage sustained engagement.

5. Burns

A cryptocurrency token burn is a process where a certain number of tokens are permanently removed from circulation by sending them to an inaccessible address. This is done to decrease the total supply of tokens, thereby increasing the scarcity and potentially the value of the remaining tokens. Token burns can reward existing holders, correct over-issuance, incentivise participation, and improve the overall health of the token ecosystem.

The token burn process involves deciding the number of tokens to burn, generating an address with no known private key (making the tokens unrecoverable), and executing the burn transaction, which is then recorded on the blockchain for transparency.

An example of this practise is Cronos (CRO), which regularly burns tokens. In February 2021, Crypto.com announced a major token burn of 70 billion CRO tokens as part of its transition to Cronos. This significant reduction in supply was aimed at enhancing the value of the remaining tokens.

Example of Crypto Tokenomics: Solana (SOL)

Introduction to SOL

Solana (SOL) is a high-performance blockchain platform designed for decentralised applications (dapps) and cryptocurrencies. It boasts fast transaction speeds and low fees, achieved through a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS). Solana aims to provide scalability without compromising decentralisation, making it a popular choice for developers and projects in the decentralised finance (DeFi) and non-fungible token (NFT) spaces. The Solana ecosystem is especially popular for its meme coins, including Popcat (POPCAT), dogwifhat (WIF), and Bonk (BONK).

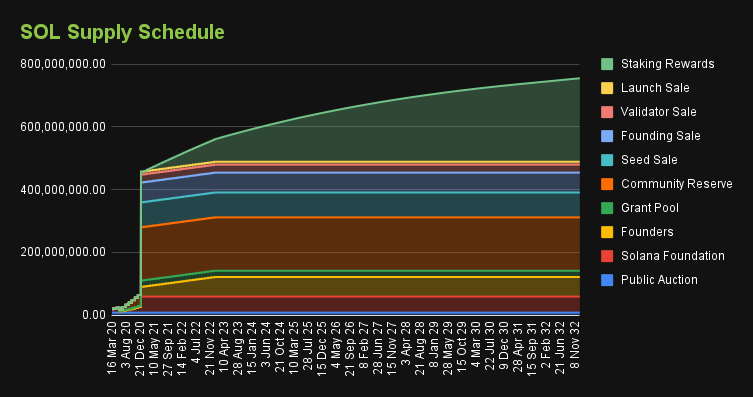

SOL Supply

Solana’s supply is uncapped and governed by a disinflationary emission rate with a long-term targeted inflation rate of 1.5%. The current circulating supply is 462,777,281 tokens, while its total supply (including burnt tokens) amounts to 579,381,310 tokens. According to the Solana team, supply of SOL is expected to reach 700 million tokens by January 2030.

SOL Distribution

The initial token distribution for Solana was as follows:

- 15.86% allocated to Seed Sale

- 12.63% allocated to Founding Sale

- 5.07% allocated to Validator Sale

- 1.84% allocated to Strategic Sale

- 1.60% allocated to Public Auction Sale

- 12.50% allocated to Team

- 12.50% allocated to Foundation

- 38.00% allocated to Community Reserve

Much of the allocated supply is still locked up. Below is an infographic with unlock dates:

SOL Utility

The Solana (SOL) token is used for three main purposes within the Solana ecosystem:

- Transaction Fees: SOL is used to pay for transaction fees on the Solana network, ensuring smooth and secure transactions.

- Staking: SOL can be staked to help secure the network and participate in the consensus process, earning rewards in return.

- Governance: SOL holders can participate in governance decisions, influencing the future development and direction of the Solana protocol.

SOL Incentives

Solana offers several incentives to token holders:

- Staking Rewards: Token holders can stake their SOL tokens to support the network’s security and consensus mechanism. In return, they earn staking rewards, which are paid out in SOL.

- Delegation: Holders who do not wish to run their own validator nodes can delegate their SOL to a validator and receive a portion of the staking rewards generated by that validator.

- Governance Participation: By participating in governance decisions, SOL holders can have a say in the future development and upgrades of the Solana network, potentially influencing their holdings and features that can benefit the ecosystem.

SOL Burns

As part of its economic model, Solana employs a token-burning mechanism to control the supply of SOL tokens and incentivise network participants. A portion of the transaction fees on the Solana network is burned, meaning those SOL tokens are permanently removed from circulation. This burning mechanism creates deflationary pressure, potentially increasing the value of the remaining SOL tokens by reducing the uncapped overall supply.

Solana’s burn rate is determined by the network’s usage and the volume of transactions (i.e., as the network grows and more transactions occur, more SOL tokens are burned). This design aligns the incentives of network participants and promotes long-term value stability and appreciation for SOL holders.

Conclusion on Crypto Tokenomics

Understanding tokenomics, which encompasses the economic principles and strategies that impact a cryptocurrency’s supply, demand, distribution, and valuation, is essential for any cryptocurrency trader. Key factors like token supply, distribution, utility, token burns, and incentives play a critical role in determining the success and sustainability of a cryptocurrency project.

By examining examples like SOL, we can see how effective tokenomics can drive growth, adoption, and value in the cryptocurrency ecosystem. As the crypto landscape continues to evolve, a solid grasp of tokenomics will remain crucial for navigating this dynamic and exciting field.

Due Diligence and Do Your Own Research

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, cybersecurity, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Crypto.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.